Imagine this: It’s the last day of the quarter. Your team is ready to close the books, but suddenly, your finance system goes down. Invoices freeze, payroll halts, and your CFO is on the phone with the CEO explaining why forecasts are now guesswork.

When systems fail, income can stall but costs continue, and the accuracy of financial planning is immediately compromised. In an environment where stability and predictability are vital, even brief periods of disruption can reshape a company’s financial outlook.

The financial reality behind downtime

On average, UK SMEs face 14 hours of unplanned downtime annually, plus another nine hours of recovery, equivalent to nearly three full working days lost. With the average incident costing £212,000, it’s clear the financial impact stretches far beyond the IT department.

During these outages, fixed costs continue to accumulate while output stalls. Teams can’t complete billable work, transactions are delayed, and customer commitments are missed. For example, a 50-person consultancy billing £150 per hour could lose over £100,000 in revenue during a single outage, before recovery costs. This disruption isn’t limited to short-term cashflow, as it affects sales pipelines, project profitability, reputation and ultimately, the organisation’s ability to hit its financial targets.

The domino effect on financial performance

Downtime rarely affects only one system. A single IT failure can create a number of financial consequences:

- Disrupted revenue streams: If customers can’t place orders, access portals, or complete payments, income is lost instantly and sometimes even permanently.

- Rising operational costs: Emergency technical support, data recovery and overtime create unplanned expenditure at a time when budgets are already under pressure.

- Delayed financial reporting: When systems are unavailable, finance teams lose access to real-time data, making it harder to produce accurate reports, manage compliance, and support strategic decisions.

- Damaged customer confidence: Interruptions to service reduce trust and may lead to contract terminations, compensation claims or renegotiations.

For many SMEs, the ripple effects will last for months, not days.

Why proactive protection makes financial sense

When viewed through a financial lens, proactive IT management offers significantly better value than reacting to failures after the event.

Employing a full-time IT manager may seem like a logical solution, but for many SMEs, the total cost of salaries, benefits, training, and overheads can quickly add up. You may also end up with a key person dependency and potential single point of failure during periods of absence.

In comparison, outsourced IT support typically costs much less and delivers far more. It provides access to a broader team of specialists, around-the-clock monitoring and proactive maintenance designed to stop problems before they start.

Safeguarding profitability and future growth

For CFOs and finance directors, the question isn’t whether downtime is costly, it’s how to minimise the risk. Protecting operational continuity is essential for maintaining predictable cashflow, accurate reporting and long-term financial resilience.

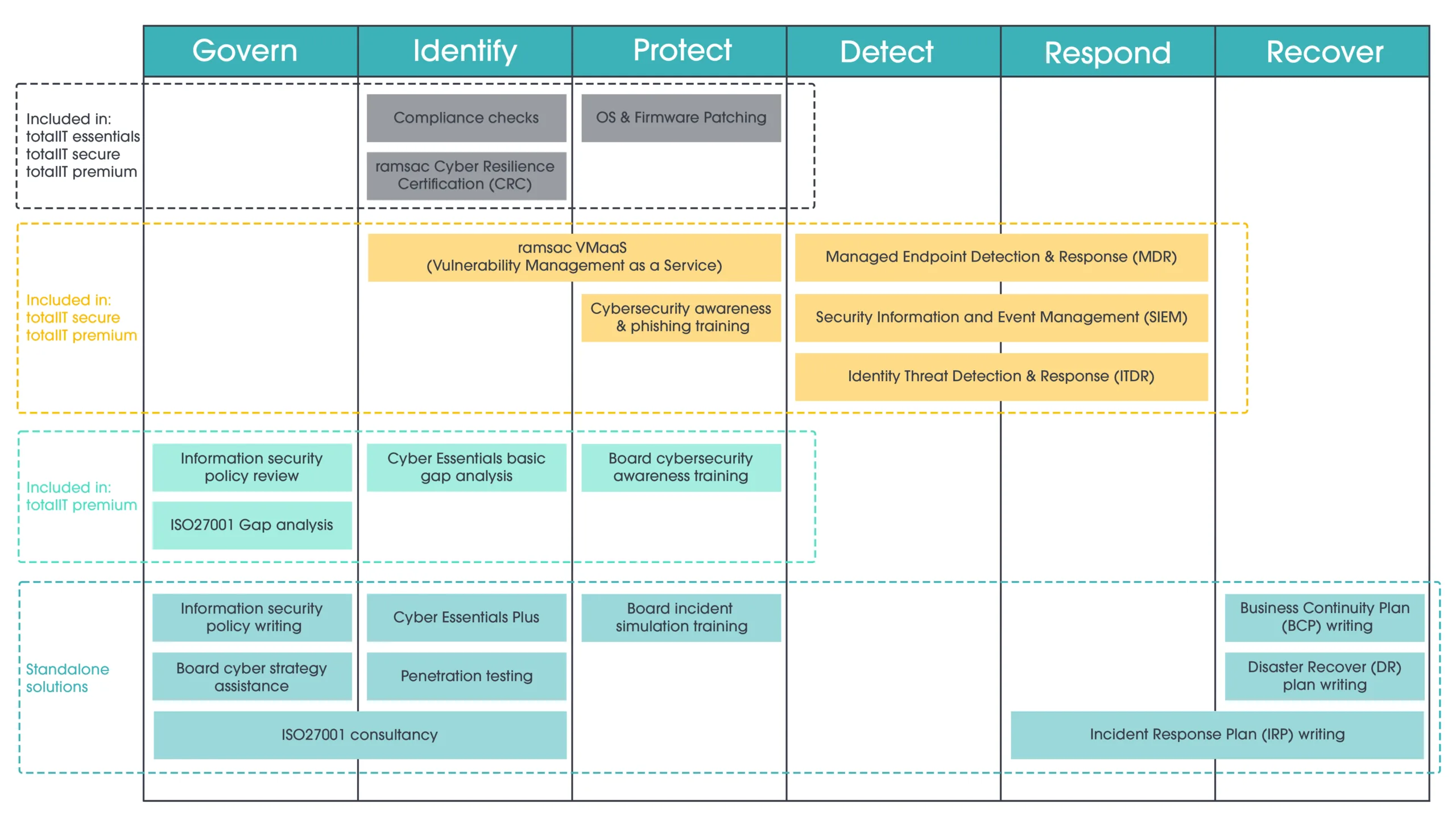

With the right IT partner, downtime becomes manageable rather than inevitable. Regular patching, continuous monitoring, cybersecurity planning, and strategic reviews ensure systems remain robust and aligned with business goals.

Don’t wait for downtime to derail your financial targets. Get in touch with us today to review your IT setup and protect your bottom line.

At ramsac, we believe IT should strengthen your organisation, not expose it to financial risk. Our proactive managed IT services are built to keep systems running reliably, helping finance leaders maintain control, protect revenue, and avoid costly disruption.

Find out how ramsac’s totalIT solutions help finance leaders protect their bottom line and prevent costly disruption.

How can we help you?

We’d love to talk to you about your specific IT needs, and we’d be happy to offer a no obligation assessment of your current IT set up. Whether you are at a point of organisational change, unsure about security, or just want to sanity check your current IT arrangements, we’re here to help.

IT Downtime: What Finance Leaders Need to Know

IT downtime can halt revenue, increase operational costs and disrupt financial reporting. UK SMEs experience an average of 14 hours of unplanned downtime per year, costing around £212,000 per incident once lost income, recovery time and reputational damage are factored in.

Finance leaders rely on accurate, real-time data to forecast, report and manage cashflow. When systems fail, financial visibility disappears, increasing risk, delaying reporting and creating uncertainty around budgets and performance.

The effects extend beyond the outage itself. Organisations may face missed deadlines, stalled pipelines, reduced customer confidence, compensation claims and long-term profitability challenges. Recovery often takes months, not days.

Yes. Proactive IT support prevents issues before they occur, reducing downtime and protecting revenue. Outsourced IT services typically offer broader expertise and lower cost compared to hiring a full-time IT manager, without creating single-person dependency.

Implement continuous monitoring, regular patching, cybersecurity controls, clear backup processes and strategic IT reviews. Partnering with a proactive managed IT provider ensures issues are identified and resolved before they escalate.

ramsac’s totalIT services deliver proactive monitoring, system maintenance, cyber protection and strategic guidance designed to minimise downtime, protect cashflow and ensure finance teams always have access to reliable, accurate data.